For decades, China has represented the pinnacle of global trade. As companies around the world began offshoring manufacturing to China to cut costs, the country emerged as an international export leader.

However, recent trade patterns signal a changing tide in global supply chain dynamics. In 2023, Mexico became the US’s top trader, outpacing China for the first time in 20 years.

The shift reflects an emerging trend called nearshoring, where companies bring production hubs closer to their main markets. Doing so helps cut supply chain costs, reduce logistical hurdles, and swiftly respond to changing market conditions and consumer demand. During the first three quarters of 2023, foreign companies invested 47 percent more in nearshoring efforts in Mexico, mostly focused on the auto sector.

Nearshoring’s recent popularity has been fueled by a combination of forces. As tensions rise in the US-China trade war, sparked by tariffs the US imposed in 2018 that led to retaliatory tariffs by China, many companies are choosing suppliers outside China to avoid rising costs. Delays in long-distance supply chains caused by the Covid-19 pandemic drove many companies to find new suppliers closer to home. Favorable trade policies tied to the United States-Mexico-Canada Agreement (USMCA) further incentivize supply chain relocation.

If you are considering whether nearshoring to Mexico is right for your organization, knowing where to focus your due diligence efforts can help determine if the benefits of supply chain relocation outweigh the costs.

The benefits of nearshoring to Mexico

Moving all or parts of your supply chain operations to Mexico can offer your organization a range of advantages.

Cost savings across multiple areas

Shorter transit times can help you save on transportation and tariff costs. Closer proximity also means businesses can operate with lower inventory levels, helping to reduce overhead and storage costs. Additionally, manufacturing costs and labor wages are generally cheaper in Mexico than in China.

Reduced geopolitical risk

Diversifying your sourcing by shifting to Mexico can help create a resilient, regionally balanced supply chain, making it easier to adjust operations to mitigate unexpected disruptions, such as geopolitical tensions and natural disasters.

Sustainability benefits

Shorter routes can help your organization reduce greenhouse gas emissions to support your environmental, social, and governance (ESG) goals.

Strong talent pool and evolving innovation

Mexico is becoming known for its highly skilled, productive workforce because of public-private investments in engineering, manufacturing operations, and technical training. Mexico’s manufacturing base is also rapidly evolving, driving innovation in aerospace, semiconductors, electronics, automotive, biotech, and medical devices.

The challenges of nearshoring to Mexico

For all its benefits, nearshoring to Mexico also presents companies with a new set of challenges.

Plan for steep compliance requirements

Mexico is party to more high-standard free trade agreements (FTA) than China, which typically involve more compliance obligations and risks. If you plan to export final products to the US or Canada, you must comply with the rigorous requirements of USMCA. For example, USMCA requires that at least 75 percent of automotive components be made in North America, which means automakers must collect information from partners across the entire supply chain. You may need to work with supply chain software solutions like e2open that can help you comply with international trade regulations—and Mexican law—while taking advantage of the many available FTAs and manufacturing and export programs to maximize savings.

Understand the infrastructure challenges

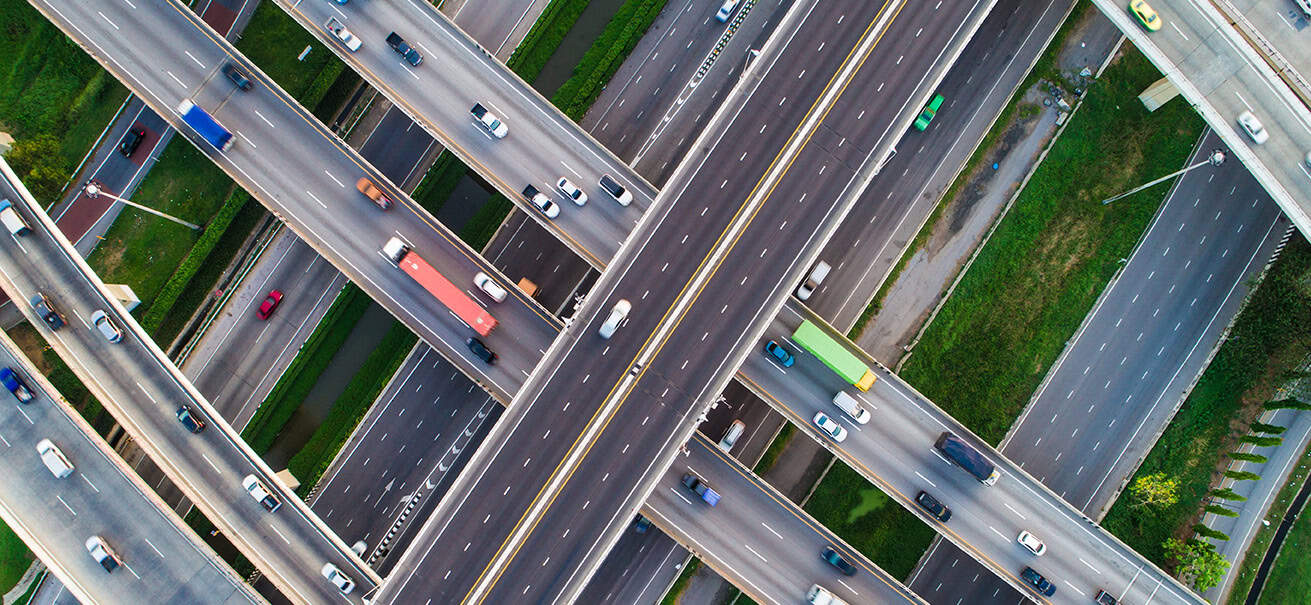

Though Mexico has many industrial parks and a robust network of highways, railways, and ports, it has limited industrial and contract manufacturing capacity compared to China. Many industrial parks along the US border are already at maximum occupancy. Mexico is also generally less connected to global value chains than China, which can drive up the cost of raw materials or hinder manufacturing. Right now, you may be stuck paying a premium for industrial space and resources, which can cut into your manufacturing cost savings. The Mexican government and foreign companies are currently investing heavily in expanding its industrial capacity. How quickly these efforts materialize will be critical in whether Mexico has the infrastructure to support your organization’s unique initiatives.

Adopt tools to navigate border bottlenecks

Increased trade puts strain on US-Mexico transportation lanes, which may bog down border crossings and customs processing. Truckload volumes at the Laredo, Texas gateway—the busiest US trade gateway—have increased by 117 percent in May 2024 compared to May 2019. Most trucks crossing the border are headed north, creating a bottleneck at US customs. To limit delays, take advantage of programs like the Customs-Trade Partnership Against Terrorism (CTPAT) and Operador Económico Autorizado (OEA) that streamline customs processing and inspections. The e2open platform offers Global Trade applications to expedite border crossings, including automated customs filing, due diligence, and regulatory checks.

Streamline nearshoring efforts with an advanced management platform

When it’s time to begin setting up operations in Mexico, working with a supply chain software company like e2open can help you relocate supply chain operations cost-effectively while reducing compliance risk.

Streamline your search for new suppliers in Mexico with our vast partner network. This network gives you access to trusted partners across the full supply chain, including manufacturing, suppliers, and logistics pipelines. Using a single platform, you can quickly find, screen, and onboard the right trading partners at every supply tier and across every mode of transportation.

Our Supply Network Discovery enhances visibility into your supply base for better collaboration with new and existing partners. By consolidating key information and documentation of all sub-tier suppliers in one view, our platform helps you monitor the components, ingredients, and raw materials that go into your products to ensure your organization complies with rigorous international trade regulations like USCMA.

Our platform also has Global Trade solutions that automatically identify eligible FTAs and duty savings programs and automate the documentation process, helping you meet compliance requirements with minimal effort.

As you begin working with new partners along new routes, the e2open platform provides tools to help ensure every package arrives on time. Our Logistics Visibility solution offers real-time tracking of goods on the move—across all carrier methods in every region—so you can proactively avoid delays and optimize upstream and downstream operations.

Start your nearshoring journey today

While nearshoring offers improved margins and efficiency, it may not be the right fit for every organization. If you decide to make the move—or need help understanding your options—e2open can help make the process easier.

Reach out to learn how we can help you with your supply chain journey.