If you are a consumer electronics brand, this is definitely for you. If you are a consumer goods brand manufacturer, read on as well! We will explore expectations and strategies for you to drive higher sales during the holiday season.

The hard figures for consumer goods and electronics sales

Melissa Repko, commenting for CNBCi, mentioned that, according to Adobe Analytics, 31.1% of the online consumer goods sales last year happened during the holiday season (between November 1st and December 31st) and grew by 3.5% over the same period in the previous year. Significant discounts in many popular categories fueled this growth as consumers held out for better prices. Toy discounts peaked at 34% off the listed price during the holiday season, up from 19% in the previous year; electronics discounts went up to 25% from 8% in 2021, and apparel reached 19%, up from 13% a year ago.

According to Bardii, Google’s generative AI engine, last year, consumer electronics brands offered discounts during the peak holiday season in every electronics category, with mixed results:

| Category | Discounts offered | Estimated impact on sales |

| Smartphones | 15-20% | Increased sales by 5-7% |

| Laptops | 10-15% | Increased sales by 4-6% |

| Tablets | 5-10% | Increased sales by 3-5% |

| TVs | 5-10% | Increased sales by 2-4% |

| Wearables | 3-5% | Increased sales by 1-3% |

| Smart home devices | 2-4% | Increased sales by 1-2% |

Perhaps most telling is what we find in the 2022 Holiday Retail Review report by RetailWire (available from RetailWire on request). The report states that by the end of last year, an estimated 10% of consumer electronics that were projected to move remained unsold despite discounts offered by brands.

The economic projections for consumer electronics

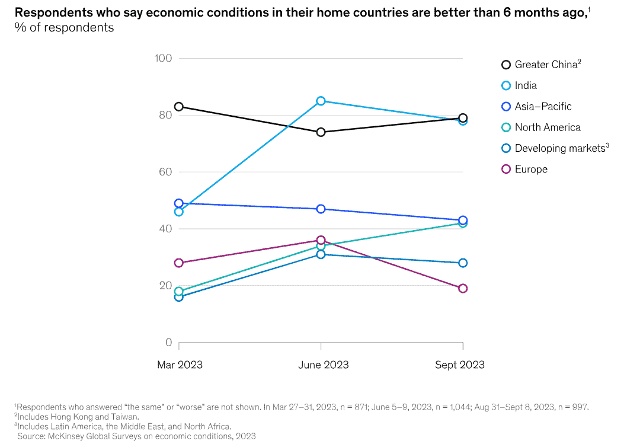

McKinsey & Co.iii submits that the economic conditions (or at least the perception of them) are improving for Greater China and North America but worsening for the rest of the world’s major economies.

With our eyes still on the consumer electronics industry, how will sales play out for the rest of the year? The US accounts for approximately 20% of the market for consumer electronics, Statistaiv estimates. Still, will this offset the perception of tougher economic conditions and increased cost of living elsewhere? There’s a good chance that consumer electronics brands ramping up for the holiday season will not have plain sailing, especially at the high end of the market.

Though higher-end brands are more desirable as gifts, the lack of disposable income and more cautious consumer attitudes may curb spending and divert it to good-quality consumer electronics from mid-range or even low-priced brands. Top-end brands may focus on the top-end earners, who are less impacted by the higher living costs, and concentrate on communicating their products’ differentiated value.

Deep holiday season discounts will be a given for the other brands, but this will raise questions. Will the discounts work? Will they lead to a spiraling cycle of price cuts continuously eroding margins? Will consumers welcome the discounts? Or will they start questioning the quality and value of the products discounted?

Strategies for brands to maximize sales during the holiday season

There are ways for brands to mitigate the risks and strive to maximize holiday season sales. The key is to increase the desirability of their products compared to their competitors and other alternatives. The holiday season is the gifting season. Brands must try to make their products the gift of choice, to be the must-have gadget everybody wants.

Leveraging influencers

Media and in-store advertising have been the de facto standard for driving awareness and desire for holiday gifts. With the growth of online purchasing, new opportunities have become available. The phenomenal popularity of social media platforms has opened the door to creating desirability via influencers. However, successfully implementing influencer campaigns requires a sound strategy. It helps to consider choosing who to work with based on the size of their following and their digital footprint (or online “hangouts”). That is just the first step, though. The hard part, and where you need to invest, is gaining their support and loyalty. To do that, you must first enable them with digital content, provide access to the physical product or service, and offer attractive incentives and rewards to sway them to your side and keep them there.

Rewards management and marketing automation applications can provide the tools to scale your influencer strategy. A channel marketing automation solution will help you manage the content you provide, effectively acting as your repository for anything from advertising or explainer videos to flyers, brochures, guides, posts, and anything else you might think of. You must also generate the individual links that influencers can use to direct online traffic to you and give you an idea of the contribution their influence is making toward your goals. Then, using an application to manage the funds spent on influencer marketing will enable you to recognize and reward your influencers appropriately.

Working with distributors and wholesalers

Consumers buy their electronics primarily via retail, in-store, or online channels (as most would expect). Retailers get their stock from distributors and wholesalers. Another strategy would be to offer distributors post-sale incentives to motivate them to carry, promote, and sell your products rather than your competitors’. With cleverly-defined volume, tiered rebates, and ingenious combinations with funds and Sales Performance Incentive Funds (SPIFFs), the beauty of this strategy is that you will not get into a game of one-upmanship on price cuts. And you only pay for performance. Incentives management applications capable of handling large-scale complex programs and layering intricate rebate definitions with objective-based funding and individual rewards can make this strategy easy to execute. Once you have that, the only limit is your imagination.

Addressing returns

Did you know that according to the National Retail Federation (NRF)v, the average return rate for all retail products is about 16.5%? However, the return rate for consumer electronics products is typically higher, ranging from 15% to 20%. Just compute how many consumer electronics received as gifts during the holiday season get returned in January. This adds to the unsold stock, and what is more, you have additional costs: admin costs for processing returns, testing and repackaging the goods, or having to offer deeper discounts on returned products.

There may be a way to reduce the volume of returns using incentives. Offering end users cash back when registering a product may persuade consumers to hold on to their gifts. Look for rewards applications where end-user promotions, such as the one mentioned, are easy to set up and manage, and don’t forget to ask about analytics to help you understand how well they work.

Each of the three approaches—influencer, distributor, or consumer incentives—may help drive sales during November-December, so you don’t have to slash prices dramatically in January. But imagine what you could achieve if you combined all three. E2open incentive solutions are all connected, so you can connect to your buyers and partners and sway their behavior through all these tactics. November is already upon us, so it may be too late for this season if you are not an e2open customer already. For the next season of giving, why not give yourself a chance?

Would you like to learn more? Talk to one of our experts at e2open!

[iii] https://bard.google.com using query: What were the discounts offered on consumer electronics, by category, last year, during the holiday season, and what was the estimated impact on sales in percentage. Please provide sources with links.

[iii] Economic conditions outlook during turbulent times, September 2023

[iv] “Global Consumer Electronics Market Size: Market Share & Revenue 2022-2033.”, Statista

[v] 2022 Retail Returns Rate Remains Flat at $816 Billion, NRF