If you regularly spend any amount of time on social media or YouTube, you’ve probably seen a popular style of content come across your feed: A cheery influencer opens their mail and excitedly shares a rundown of the products they ordered, piece by piece.

We’re talking about unboxing videos of course, and whether it’s cheap dresses or sneakers, accessories for your next Dungeons & Dragons campaign, or home goods like lazy susans and outdoor grill gadgets, more and more influencer videos feature products from Chinese online shopping platforms Temu and Shein—at impossibly low prices.

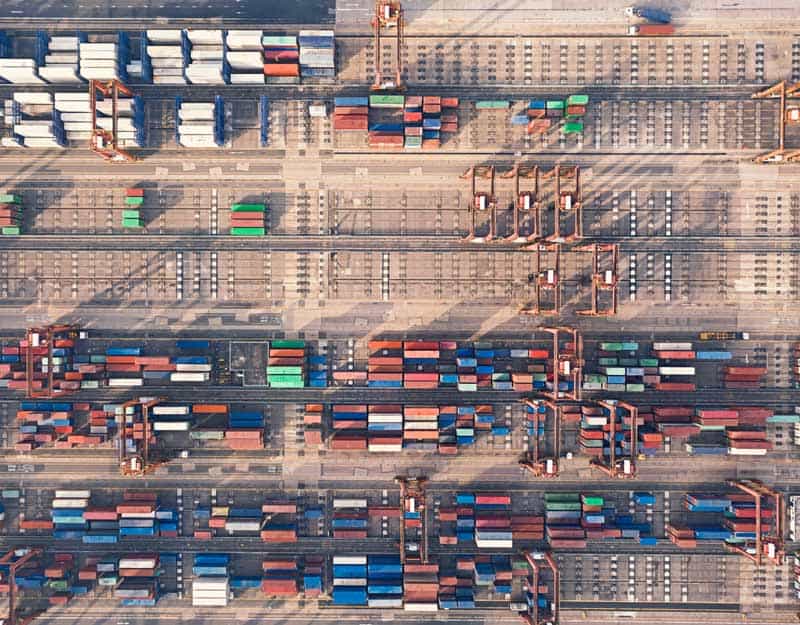

The surge is partly due to de minimis trade, a US import rule that allows shipments of up to $800 to be exempt from taxes and formal customs declarations as long as the packages are addressed to individuals. Taking advantage of reduced costs, global retailers imported 1 billion de minimis shipments into the US last year, a 53 percent increase from 2022. Temu and Shein likely account for more than 30 percent of these shipments, and Chinese companies account for nearly half.

The skyrocketing import volumes have triggered new measures by the US Customs Border and Protection (CBP) to prevent retailers from exploiting de minimis trade, and there may be more changes on the way from lawmakers. In this article, we’ll break down how to best navigate the immediate de minimis changes and how e2open can help you optimize global trade costs if future changes roll out.

The growing challenges of de minimis trade

De minimis was originally created in 1938 to simplify the customs process for American travelers wishing to ship souvenirs home. However, when Congress raised de minimis from $200 to $800 in 2016, the US threshold became one of the highest in the world, leading to a boom in ecommerce imports.

So what’s the problem with these imports? For one, CBP staff is struggling to keep up with the surge in de minimis shipments. More importantly, CBP worries that bad actors are exploiting the relaxed customs inspections to smuggle harmful goods, as de minimis shipments account for over 90 percent of illegal narcotics, agricultural goods, and counterfeit products found by CBP. To make it worse, CBP has access to limited data from carriers, which slows down processing at the border and makes it harder to screen packages for illegal contents.

Others argue that tariff-free trade creates a loophole that gives global competitors—particularly Chinese businesses—an unfair advantage over US businesses. For example, a June 2023 US House of Representatives committee study found that while H&M paid $205 million and Gap paid $700 million in import duties in 2022, Temu and Shein paid nothing. In light of fast US market share growth for Temu and Shein, the US International Trade Commission pointed out that some critics have called de minimis “an outdated program not suited to the current trade environment.”

What changes are happening now?

In late May, CBP announced it would be taking immediate action to limit exploitation of the de minimis, including enhanced enforcement to ensure compliance across customs brokers, carriers, and supply chain businesses. The statement said CBP had already suspended multiple brokers that failed to comply.

Lawmakers are considering further adjustments to the de minimis, such as eliminating de minimis for Chinese imports or eliminating the rule altogether.

How to navigate de minimis right now

While it’s uncertain what future changes are around the corner, the CBP measures mean more scrutiny for all de minimis shipments. Providing CBP with thorough documentation can help limit the disruption on your supply chain.

- Report accurate valuations: Be forthright about the full commercial value of shipments. Undervaluing goods in an attempt to slide below the de minimis threshold is a growing focus for CBP. You could face penalties or suspension.

- Provide complete product descriptions: Share as many details as possible, such as materials, country of origin, and the Harmonized Tariff System (HTS) code. Incomplete or incorrect information can lead to delays, duty misclassifications, or seizures.

- Prioritize legal compliance: Beyond de minimis, stay on top of other regulatory requirements, such as banned entities and trading partners and special licenses for certain goods.

As the de minimis rule faces increased congressional scrutiny, it’s important to stay informed. Follow news and government sites like the CBP website and connect with trade professionals to ensure you don’t miss important updates.

Additionally, working with a supply chain management company like e2open can make it easy to stay updated on changes to not only the US de minimis threshold but worldwide thresholds, global trade regulations, and duties savings programs. With access to the world’s most current international trade database, we can help you comply with changing regulations and align your supply chain routes to maximize cost savings.

Bring efficiency and automation to your de minimis trade

As you evaluate ways to improve record keeping and consolidate documentation, managing your supply network on the e2open platform can simplify the process. Our Global Trade Management solution provides a single source for compliance, duty management, and customs filing.

By maintaining records of all trade activities in one place, the e2open platform streamlines compliance, duty management, and customs filing. We even offer tools to automate the due diligence, regulatory checks, and customs declarations self-filing process to help you save time and reduce brokers fees. The platform also lets you manage suppliers across all tiers, helping you manage ESG compliance and reporting.

If you need help navigating de minimis or want to improve the efficiency of your global supply chains, connect with our team.